R&D Tax Incentive 101: How Startups Can Get Up to 43.5% Cash Back

It's there to stop people being scared of innovating - to encourage companies to try things that do not have a guaranteed outcome... A lot of projects end up never being completed or are discontinued. Even if you make no money from a project, if it is eligible you can still claim.

R&D Tax Incentive 101: How Startups Can Get Up to 43.5% Cash Back

Most startups die for one simple reason: they run out of cash before they can finish building a product people want.

In Australia, there is a government program specifically designed to reduce that risk — yet many first-time founders either don’t know about it, or assume it doesn’t apply to them.

It’s called the Research and Development Tax Incentive, and for startups doing real product development, it can return up to 43.5% of your eligible R&D spend in cash.

When we spoke with Jasper Steel from Grant Help, a company that specialises in helping startups with their R&D tax claims. His team often works with startups that would not make it into their second year without this refund.

He mentioned a case that has stayed with him: The founders were facing a terrible choice: accept investment on highly unfavourable terms that would heavily dilute their equity, or shut down the company entirely. The R&D tax refund gave them a third option. It bought them enough runway to keep building, keep iterating, and eventually raise on terms that made sense. Today, they're a thriving company that continues to invest heavily in new technology each year.

Then he paused and explained why the scheme exists in the first place: “It’s there to stop people being scared of innovating - to encourage companies to try things that do not have a guaranteed outcome"

That is exactly what most startups are doing.

This guide explains: what the R&D Tax Incentive actually is, who it’s for, what you can claim, and how to approach it without taking unnecessary risk.

Why the R&D Tax Incentive Matters for Early-Stage Startups

If you are building a startup, you are spending money on things that are uncertain by definition: building new systems, solving problems that don’t have obvious answers, and experimenting your way toward a working product.

When the conversation turned to what the program is really designed to do, Jasper didn’t talk about tax at all. He talked about risk. As he explained it, “The idea behind it is to reduce the risk of innovation.”

He also pointed out something many founders don’t realise: not every R&D project succeeds. Some take years. Some fail completely. And that does not disqualify you. As he put it, “A lot of projects… end up never being completed or are discontinued. Even if you make no money from a project, if it is eligible you can still claim."

Unlike grants or pitch competitions, the R&D Tax Incentive is:

- Not a loan

- Not equity

- Not competitive

- An entitlement-based cash refund

Who Can Claim and How Much You Can Get Back (Up to 43.5%)

You may be eligible if:

- You are an Australian incorporated company

- You are conducting genuine R&D activities in Australia

- Your work involves experimentation and technical uncertainty

- You are trying to create new or improved products, software, systems, or knowledge

- You spend at least $20,000 on eligible R&D activities in a financial year.

- If your R&D spend is below this threshold, you can still access the incentive by engaging a Registered Research Service Provider (RSP) to conduct your R&D work.

You DO NOT need to:

- Be profitable

- Have revenue

- Be in a specific industry

- Be a certain size

Yes — you can get a cash refund even if your startup has no revenue

This is the part that usually surprises founders.

Jasper explained it very plainly during our conversation: “You don't actually have to be earning revenue… it's focused on whether you're actually conducting the R&D and incurring that risk.”

For early-stage startups, the refund can be up to 43.5% of eligible R&D spend.

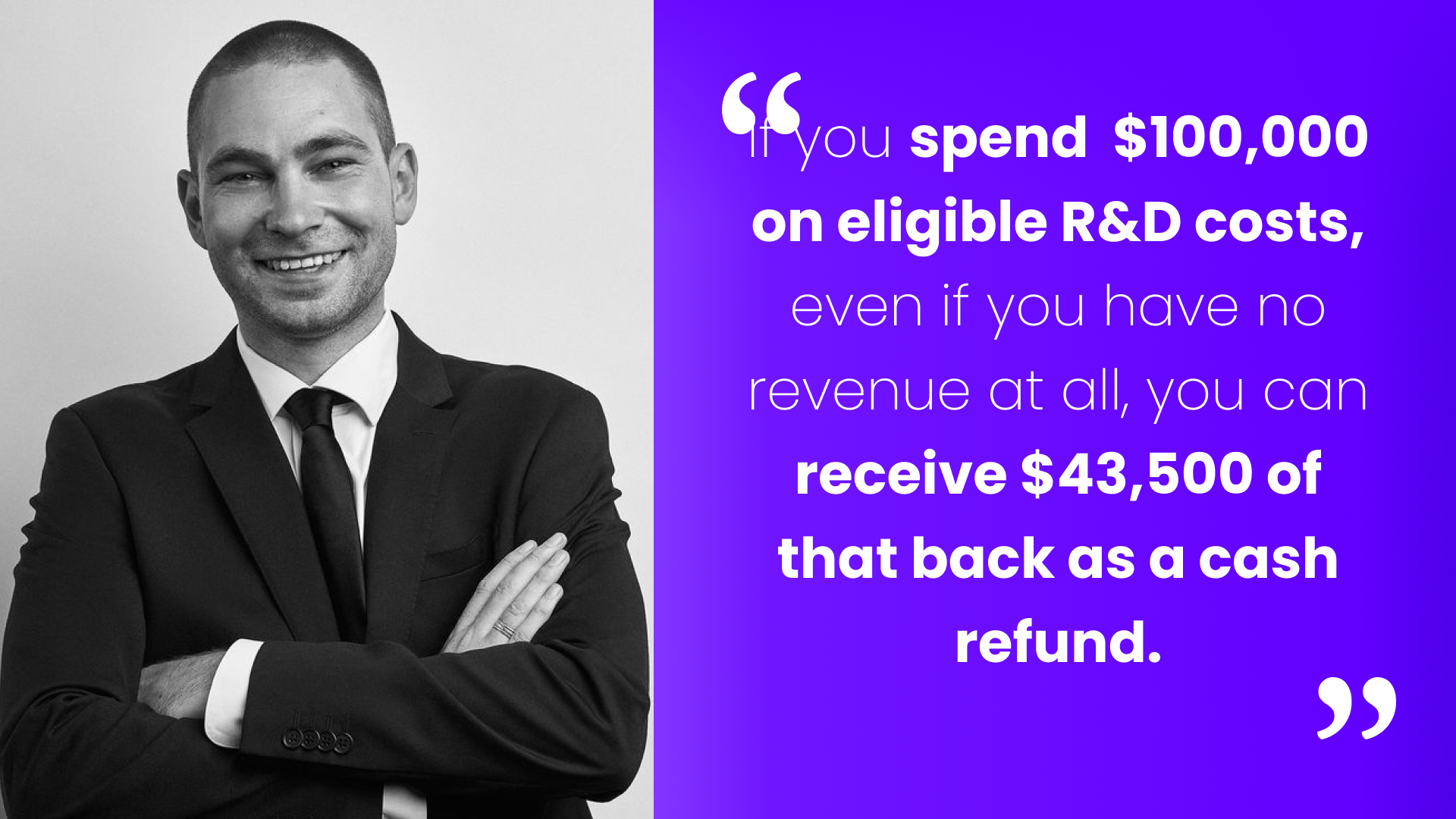

He then gave a simple example: “If you spend $100,000 on eligible R&D costs, even if you have no revenue at all, you can receive $43,500 of that back as a cash refund.”

If you do have tax to pay, the offset is applied first. But, as he added, “For most eligible startups that have no revenue, they can get the whole thing back as a cash reimbursement.”

"We're Not a Startup — Does This Apply to Us?"

Yes. Absolutely.

While this guide focuses on early-stage startups, the R&D Tax Incentive is available to any Australian incorporated company conducting genuine R&D work — regardless of size, age, or industry.

As Jasper explained, "It's open to a huge range of industries. We see a really broad range of different development projects that are eligible to claim for this programme."

If your business is:

- Developing new products, processes, or systems

- Improving existing technology or methods

- Facing genuine technical uncertainty in your work

- Experimenting to solve problems where the solution isn't obvious

Then you may be eligible — whether you're a manufacturing business, construction company, consultancy, food producer, engineering firm, or any other industry doing genuine R&D.

This Isn't a One-Time Grant — It's Annual Funding

One of the most important things to understand about the R&D Tax Incentive is that it's not a one-off program you apply for once.

As Jasper explained, "It is something that businesses can apply for every year" — unlike many other government programs that only have a few rounds or are one-time opportunities.

If your startup is conducting genuine R&D work year after year, you can claim year after year.

Near the end of our conversation, Jasper emphasised this point again: "This is just one thing businesses should be considering every year as part of their funding plan… We have helped startups see their claims grow each year significantly."

For startups doing continuous product development, this means predictable, recurring, non-dilutive funding — not a windfall, but a reliable revenue stream that reduces the cost of innovation over time.

What Types of R&D Work and Costs Are Claimable?

You can generally claim costs that are directly related to eligible R&D activities, including:

- Wages and employee costs (including super)

- Contractor and consultant costs

- Prototypes and testing

- Materials and consumables

- Software and development tools

- Depreciation of R&D assets

- Some overheads (rent, utilities, etc.)

- University or research organisation costs

There are two types of activities:

- Core R&D activities: experimentation, testing, hypothesis validation

- Supporting activities: work that enables or supports those experiments

When walking through this, Jasper summed it up simply: “As long as an expense is directly related to conducting an eligible core or supporting R&D activity, you can likely claim it.”

What the R&D Tax Incentive Does Not Cover

You cannot claim for:

- Marketing or sales

- Commercialisation or manufacturing

- Routine development or business-as-usual engineering

- Offshore development or overseas labour (exceptions can be made if R&D requires facilities, expertise or equipment not available in Australia)

- Market research

- User research or UX/UI

- Cosmetic changes

- Quality control

At one point, Jasper stopped to draw a very clear line: “The kind of risk that this research has to be mitigating are strictly for technical risks. They're not for, for example, market risk.”

That is the easiest way to think about it.

How the R&D Tax Incentive Claim Process Actually Works

In Australia:

- Claims are lodged after the end of the financial year (30 June)

- You must submit within 10 months of year end (by 30 April the following year)

- Most founders submit during January to March — this is when the bulk of claims happen

When engaging a consultant like Grant Help, the preparation phase is relatively quick. Jasper said that in most cases, "We can typically get someone wrapped up and submitted in about 4 to 6 weeks depending on how quickly you can supply the necessary documentation."

After submission, you're in the government's hands:

After submission, you're in the government's hands:

- R&D claim processing: Automatic once your tax return is processed

- Refund payment: Typically within 28 days of your R&D claim being processed

"It's not instant," Jasper said. "The government is cautious to hand out taxpayer money, and a weak application can lead to an extended review period."

All up, founders should expect the application and payment process to take a few months.

When It Makes Sense to Use an R&D Tax Specialist (and Why It Reduces Risk)

When asked where startups usually get into trouble, Jasper answered immediately: documentation.

As he put it, “The main issue I see with people… is people need to get better about their documentation.” And later in the conversation, he added, “The better the record you have, the easier that claim is, and the better that claim will be.”

Without proper records, claims can be delayed, become stressful to defend, or fall apart entirely under review. And the stakes are real: if a claim is poorly submitted and the ATO suspects malpractice, a wider audit may be conducted into the company. The government audits around 6–7% of claims, and when they do, they'll ask for git logs, timesheets, scrum records, and other evidence that the work actually happened.

That experience matters when navigating grey areas, protecting your IP (most claims never require sharing your code), and ensuring your activities are framed in a way the ATO will accept.

The bottom line: if you're uncertain whether you're eligible, talk to someone early. The cost of not claiming could be tens or hundreds of thousands of dollars you're leaving on the table. The cost of claiming poorly could be an audit, rejected claims, or worse.

.jpeg)

Why Grant Help and How to Get Started

When we asked about Grant Help’s background, Jasper explained that their team includes people who have previously worked inside the government assessing and auditing these exact schemes.

As he described it, they hire directly out of government and work closely with the system to make sure claims are done properly.

They also work on a success basis. As he said: “You pay when we get you paid.”

This approach also sets Grant Help apart from other consultants in the space.

As Jasper explained, Grant Help’s focus is on building long-term relationships with businesses that are genuinely undertaking eligible R&D, rather than treating the R&D Tax Incentive as a one-off transaction.

Grant Help operates on a no-win, no-fee basis, meaning clients only pay once a claim has been successfully approved. This approach removes upfront cost risk for founders and ensures incentives are aligned — Grant Help is paid when the client is paid.

Some firms in the market operate on upfront or fixed-fee models, regardless of outcome. While these approaches may suit some businesses, early-stage companies often prefer a structure where fees are tied directly to successful outcomes.

Across the industry, R&D consultants typically charge around 15% of the funding received.

Final thought

Near the end of the conversation, Jasper came back to the same idea he started with: this program is about giving founders the confidence to take real technical risks.

Or, as he put it: “If you are a business, if you are looking to innovate… this is just one thing you should be considering every year as part of your funding plan.”

Beyond claim preparation, Grant Help supports clients with:

- Proprietary compliance software designed to assist with documentation, timesheeting, and reporting

- Ongoing guidance on planning R&D activities and claims in future years

- Support in identifying and connecting with other relevant government programs as businesses grow

This broader, forward-looking approach helps reduce compliance risk, improve claim quality over time, and ensure businesses are well-positioned as their R&D activities evolve.

If you think your startup might be eligible,you can talk to a specialist and get clarity on your situation. Grant Help offers an initial conversation to walk through your activities, your costs, and whether a claim makes sense for you.

Grant Help has a number of registered Tax Agents on staff, and their team includes people who have previously worked inside the government assessing and auditing these exact schemes, so they understand both how claims are prepared and how they are reviewed.

🎉 If you register for a free consultation through the SkillsRobin x Grant Help Partner Page, you will receive $200 off your first invoice, on top of your government cash refund.

https://hs.granthelp.com.au/rdti-eoi-skillsrobin